It’s possible for people with OSA to have their upper airway partially or completely blocked while they’re asleep. This can lead to gasping or snoring, as well as choking. Obstructive sleep apnea (OSA) affects between 2 and 9 percent of individuals, and CPAP machines may help you sleep better.

- Brooklyn Bedding vs. Casper Mattress Comparison: Which Is Best? Update 04/2025

- Bedgear Pillow Review Update 04/2025

- Purple Pillow Review In The Next 60 Seconds Update 04/2025

- How Best Bath Pillow Can Help You Improve Your Health? Update 04/2025

- How Often You Should Change Filters? The Best CPAP Masks Update 04/2025

For those who have difficulty sleeping, a CPAP (continuous positive airway pressure) machine sits beside your bed. When you wear a mask that covers your nose or mouth, the machine delivers pressured air to keep your airway open while you sleep. For the best benefits, your doctor will recommend that you use the CPAP machine every night after you’ve been prescribed it.

Bạn đang xem: Insurance and CPAP: How Do I Know If My Insurance Cover CPAP? Update 04/2025

However, CPAP therapy is both effective and expensive. Not adding the cost of additional equipment like filters and masks, CPAP devices can cost anywhere from $250 to $1000 or more. If you’re thinking about starting CPAP therapy, you may ask if your insurance plan will cover some of the expense.

We’ll go over some of the most prevalent CPAP-related insurance policies here. To ensure you have the most up-to-date information, always check with your insurance provider.

Does Insurance Cover CPAP Equipment?

In most cases, just a portion of the cost of CPAP machines and accompanying equipment is covered by insurance. While the machines themselves may be covered, other components, such as tubing, may be left up to you to pay for. With a cap on the number of replacement parts that can be purchased each year, some insurance policies cover the cost of replacement parts. In many cases, CPAP equipment is not covered unless you reach the annual deductible for your insurance plan.

To determine if you qualify for CPAP therapy, insurance companies often look at your apno-hypopnea index (AHI). Per hour, your AHI is the number of partial or total pauses in your breathing. A sleep study in a sleep lab or at home utilizing at-home testing equipment is the only way to assess your AHI.

The AHI score determines if sleep apnea is mild, moderate, or severe. AHIs of 5 to 15 are regarded mild, those of 15 to 30 are considered moderate, and those of 30 or more are deemed severe. CPAP devices are partially covered by Medicaid and Medicare for all three AHI indexes, if you fulfill certain requirements.” The standards of other insurance companies may be different. Be careful to examine your insurance coverage to find out what your specific needs are.

Insurance Compliance and Prescription Requirements

Two conditions must be met before most insurance providers will pay for your CPAP equipment. Your healthcare physician must first write a prescription for CPAP treatment. Another need is that you successfully complete a CPAP machine compliance period to show that you are routinely using the treatment.

CPAP machines can only be prescribed by your doctor when he or she has confirmed that your sleep problems are indeed due to sleep apnea and not something else. First, your doctor will look for the following signs of obstructive sleep apnea:

- Snoring loudly all night long.

- Snorting or gasping when sleeping.

- Overwhelming drowsiness during the day.

- Forgetfulness.

- Headaches.

- Driving while drowsy or sleeping.

The next step is to get a sleep study done if your symptoms suggest that you may have obstructive sleep apnea. Sleep apnea can be diagnosed with an overnight polysomnography (also known as an in-lab sleep study) or an at-home polysomnography (also known as an at-home sleep study). Your doctor may determine that you have sleep apnea after reviewing and interpreting the results of your sleep study and working with you to build a treatment plan.

CMS requires documentation that you use the CPAP machine at least 4 hours per night, on 70% of nights, for 30 consecutive days in order to be eligible for payment. Most machines keep track of what you do with them. In some cases, the data is transmitted via an app on your phone, while in others, it is saved to an SD card. These prerequisites must be met within the first three months, otherwise you may have to start the application process over.

Each CPAP insurance carrier has its own set of rules, and these are only the most prevalent ones. Consult your policy to learn more about the precise restrictions set forth by your policy’s issuer.

Insurance and CPAP Machines

You’ll have to check with your provider to see if your CPAP machine is covered by your insurance policy. A rent-to-own arrangement, in which you pay a monthly fee until you own the machine outright, may be offered by some providers, while others require you to pay a monthly fee before you buy the machine outright.

Depending on where you reside and the sort of equipment you require, the cost of acquiring a machine altogether might range from $250 to $1,000 or more. Between $500 and $800, most CPAP machines are available. When it comes to bi-level positive pressure ventilators (BiPAPs), the cost might easily exceed $4,000 per month.

A typical monthly price is the cost of a CPAP machine divided by the number of rental months that you are renting it for. The exact amount you pay depends on your policy and how much your insurer agrees to cover with you as a copay for their services. If you have to rent for more than a year, keep in mind that you may be compelled to pay a second deductible.

It’s possible that your insurance provider will stop paying for the machine rental if they discover that you aren’t utilizing it as much as you should be. You must determine whether or not you want to pay the monthly rental fee, buy the equipment outright, or halt CPAP therapy.

If you decide to discontinue CPAP treatment and then later decide to try it again, your insurance company may require that you re-qualify for coverage for CPAP treatment. A new diagnosis of sleep apnea and a new prescription for a CPAP machine are the result of a second sleep testing. Depending on your insurance plan and related deductible, you may have to pay for the required doctor’s appointments and sleep exams.

Insurance and CPAP Supplies

The cost of the CPAP equipment is the biggest upfront investment when starting CPAP therapy. Supplies that need to be replenished over time, such as

- Masks.

- Defend the parts.

- Tubing.

- Filters.

- Chinstraps.

- Headgear.

- The water room.

Each component has a different price tag. Filters, which must be replaced on a regular basis, range in price from $5 to $30. Masks can cost up to $100, while other necessities can cost anywhere from $20 to $100. Rental plans may cover the cost of replacement equipment, which is something to keep in mind when comparing the cost of purchasing outright versus purchasing insurance.

When it comes to replacing medical equipment, many insurance companies follow the Medicare criteria.

| Item Description | Frequency |

|---|---|

| Combination Oral/Nasal CPAP Mask | Every 3 Months |

| Full Face Mask | Every 3 Months |

| Chinstrap | Every 6 Months |

| Tubing | Every 3 Months |

| Headgear | Every 6 Months |

| Disposable Filter | Twice per Month |

| Nondisposable Filter | Every 6 Months |

| Humidifier Water Chamber | Every 6 Months |

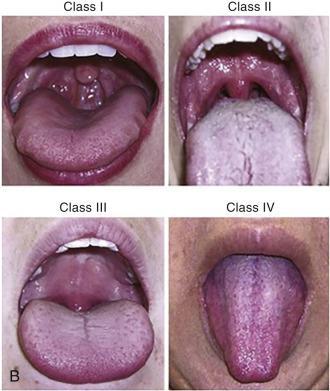

Xem thêm : Mallampati Score to Help Predict Obstructive Sleep Apnea Update 04/2025

The replacement policies differ from one provider to the next. 51 percent of state Medicaid programs follow these criteria, however 39 percent allow for less regular CPAP equipment replacement. Fewer than 10% allow for more frequent replacement. – adverb

Insurance and CPAP Accessories

As you get used to CPAP therapy, you may want to purchase additional devices to make your sleep more comfortable and travel more convenient. The CPAP machine comes with a variety of optional accessories. Among them are:

- CPAP pillows, which are tailored to fit the machine and tubing and allow you to move around while you sleep.

- To keep your machine clean and functioning for a longer period of time, consider using CPAP cleaners.

- Mask liners that can wick away moisture and maintain a tighter seal to keep the mask in place are preferred over conventional ones.

- Holders for the CPAP hoses that make the machine more comfortable to use while also making it appear less clinical.

- When you don’t have access to a power source, you can use CPAP batteries.

- For when you’re on the run, you may stow your CPAP equipment in these carry-on luggage options.

Optional purchases are generally not covered by insurance. Prices for these products might vary greatly based on the quality. The warranties on more expensive accessories might range from one to three years.

Does Medicare Cover CPAP?

As long as you meet certain requirements, Medicare will pay for CPAP machines up to 80% of the cost under Part B. An approved laboratory sleep study or an at-home sleep study must first be used to make the diagnosis of obstructive sleep apnea, and a prescription for a continuous positive airway pressure (CPAP) device must be written by your doctor for you.

Then, if you fulfill the following conditions, Medicare will pay for a 12-week trial term of CPAP therapy for obstructive sleep apnea:

- Have a sleep apnea hourly AHI between 5 and 14 and a co-occurring condition such as high blood pressure, a history of stroke or heart disease, excessive daytime drowsiness, insomnia, mental health issues, or poor cognition;

- Have a sleep apnea hourly AHI of 15 or more

During the first three months, you must use the machine at least four hours a night, 70% of the time or more, in order to meet Medicare’s compliance standards. These prerequisites must be met before you may move forward. In order to get a new prescription from your doctor, you’ll need to have another sleep study done, either in a lab or at home.

If the CPAP therapy improves your sleep apnea symptoms, Medicare will continue to cover the cost of your CPAP equipment for the next 12 weeks. You’ll have to pay 20% of the equipment rental and the cost of supplies like the mask and tubing if you have Original Medicare. Since your Medicare Plan B deductible has been met, you are eligible for 13 months of rental coverage from Medicare. After the 13-month period has elapsed, you will be the sole owner of the equipment.

Does Medicaid Cover CPAP?

Generally speaking, state Medicaid programs adhere to the same principles as federal Medicare. Obstructive sleep apnea (OSA) must be diagnosed and treated with a prescription from your doctor. In order to be eligible for Medicare, your AHI must also meet the following criteria:

- AHI score ranging from 5 to 14 and a comorbidity linked to obstructive sleep apnea are both acceptable diagnoses.

- At least a 15-point AHI.

Medicaid will pay for a 12-week trial of CPAP therapy if you fulfill these criteria. If your sleep apnea improves as a result of the CPAP treatment, your insurance will continue to cover you. As with Medicare recipients, you must use the equipment for at least four hours a night on 70% of the nights you have.

What is the difference between device rental and purchase?

Most insurance companies now cover the rental of PAP machines for a period of three to ten months. The device will be yours at the conclusion of the term. Your insurance company will be billed monthly because it is a monthly rental. Monthly billing is required for those who have a co-insurance (for more information on insurance jargon, see our Guide to Understanding Your Health Insurance).

How do I know if my insurance pays for rental or purchase?

Contacting your insurance carrier is also an option. As soon as your insurance benefits and coverage are verified by your service provider, they should be able to give you with an estimate of your expected monthly financial responsibility at the time of set-up and throughout the period of your rental. As a result, consumers and healthcare professionals have little control over whether CPAP is covered as rental or purchased by their insurance.

How much will I pay for a purchase?

In-network providers have negotiated lower prices with your insurance carrier for your PAP device if you are covered by them. An in-network physician may charge less than one who accepts your insurance but isn’t in-network (for more information on the distinction and what it means to patients, please click on this link). By gadget kind, the price also varies. It is less expensive to use CPAP or APAP than it is to use BiPAP or a bilevel device (click here to learn more about different types of PAP devices).

You’ll also get a mask, tubing, filters, and cushions, all of which will eventually need to be changed (more about that later). In order to acquire an accurate quote, you need communicate with your service provider or insurer directly.

How much will I pay for a rental?

In most cases, the rental rates are calculated by dividing the purchase price of an item by the rental term. You may learn more about purchase costs by reading “How much will I pay for a purchase?” in the previous paragraph.

Remember that the mask, tubing, filters, and cushions you received at your initial set-up will be included in your first month’s cost. It is only when you order more replacement supplies, which you should do every three months, that you will be charged for those products in future rental months.

Will my insurance company require authorization for my CPAP?

Authorizations are now required for an increasing number of treatments, including sleep studies and PAP devices, by many insurance providers, including Medicare and PPO plans. Many medical device providers will ask for your insurance company’s permission, if necessary. A prescription and a recent sleep testing demonstrating a diagnosis of obstructive sleep apnea are usually required. Sleep studies may be required for those who currently use an airway pressure-reduction device (CPAP) and who are acquiring a new one. A new sleep study is typically required by insurance companies every three years.

Paying Out-of-Pocket For CPAP Equipment

A CPAP machine’s cost can be greatly reduced by insurance policies. But if you have a high-deductible health plan, you may be tempted to purchase your CPAP equipment on your own and avoid your insurance. Be sure to check with the FDA to see whether direct-to-supplier CPAP manufacturers have lower prices than those available via your insurance plan.

Xem thêm : Sleep and Epilepsy: How Can I Help Improve My Sleep? Update 04/2025

Be sure to account for both the immediate and long-term costs of a CPAP machine before making a final selection. Don’t forget to include the cost of tubes, filters, and other replacements in your budget.

If you want to buy a CPAP machine and/or equipment, you’ll need a prescription from your doctor, even if you don’t have insurance. You’ll need to have a sleep study done before your doctor can diagnose you. Once you obtain a prescription, you have the option of purchasing CPAP equipment outright or going through your health insurance provider.

When you buy your CPAP equipment without insurance, you can avoid the rental-to-own process and immediately own your machine. By not using your insurance, you also avoid the responsibilities of treatment compliance. There is no need to return your equipment and start the procedure of receiving a prescription from your doctor again.

Paying a medical equipment supplier directly gives you access to a greater range of products. When making a purchase through an insurance company, your options are limited to the vendors that are insured by your policy. Because of this, you may not be able to acquire the precise product you want. When you pay for your CPAP machine directly, you have the freedom to shop around for the one that best suits your needs.

Frequently Asked Questions

Some of the most frequently asked questions about CPAP machines, equipment, and insurance coverage will be answered here in this section

How much will I pay for CPAP equipment?

Prices for CPAP machines can range from as little as $250 up to as much as $1000. The cost of more complex equipment tends to be higher. The price you pay is determined by the level of insurance you have.

The CPAP machine itself costs between $5 and $30, but additional equipment such as filters and masks can cost as much as $100. The majority of the rest of the gear is in the $20 to $100 range.

Does my deductible apply to CPAP equipment?

For the most part, your deductible is only applicable to the CPAP machine itself, not any additional accessories. In most cases, the frequency of replacements for components such as tubes, masks, and filters can be determined by the provider’s service plan. If you frequently need to replace a specific component, you may be responsible for those expenditures.

Will insurance pay for sleep apnea sleep studies?

You may be able to save money on sleep studies if you have insurance that covers some of the costs. In order to be covered, most insurance companies require a physician recommendation for a sleep study. What form of study is best for you will depend on your doctor’s recommendation. Most insurance companies need a medical diagnosis of obstructive sleep apnea before covering the cost of a CPAP machine and associated accessories.

Why does my insurance require proof of usage?

If you don’t use the gadget on a regular basis, your insurance provider may deny you reimbursement for the cost of the equipment. There is no need for them to foot the bill for a device that you do not even use. Consequently, documentation of compliance is now required by many insurance companies that pay for CPAP on a rental basis before they would continue renting or purchasing the device for you.

The following are the requirements to which you must adhere:

If your insurance company requires proof that you used your device for at least four hours per day for at least 22 days out of a 30-day stretch in the previous 90 days, they will likely ask for it (in the past 3 months).

How often will my insurance pay for a new device?

Every three to five years, many insurance companies will cover the purchase of a new medical gadget. A fresh sleep study may also be required by your insurance company before the new device may be approved. Make sure that you are still using the gadget and its settings are correct before you get insurance. You may need a higher or lower pressure setting if you’ve lost or gained weight, or if your health has changed in any other way.

Can You Buy CPAP Supplies Without Insurance?

Is CPAP equipment covered by health insurance? Yes. Even so, there are other options.

To purchase CPAP supplies online, you must have a prescription. You don’t have to go through a trial period as you would with insurance.

Direct sellers like CPAP.com actually provide lower costs. Why? CPAP supplies can be purchased at the most affordable prices because we do not bill or negotiate with insurance companies.

The wide range of CPAP machines available at CPAP.com ensures that you get the finest therapy for your CPAP needs. As there is no compliance period or yearly check-ins, you are free to choose the equipment that works best for you and the frequency with which you use it.

Even if your lack of sleep is causing you stress, you don’t have to make the remedy stressful. Our CPAP devices will help you get a good night’s rest, so you may wake up feeling rested and rejuvenated.

How long is the rental term?

Among the most prevalent choices are the following:

- Rental for three months, then purchase for the fourth month (many PPO insurances)

- HMO insurance and some PPO insurances are included in the 10 month rental.

- Rent for a year (Medicare and other government insurance)

Nguồn: https://www.sleepyheadpillowcase.com

Danh mục: Best Pillow Reviews